Cocoa Prices Rebound After West African Rainfall Shifts

The global cocoa market, long characterised by swings between scarcity and surfeit, is witnessing a notable comeback in prices. This uptick is rooted in shifting rainfall patterns across the major West African growing regions of Côte d’Ivoire and Ghana, and it’s sending a clear message to trade handlers, exporters and procurement teams: supply chain dynamics are changing, and adaptation is vital.

What’s driving the rebound

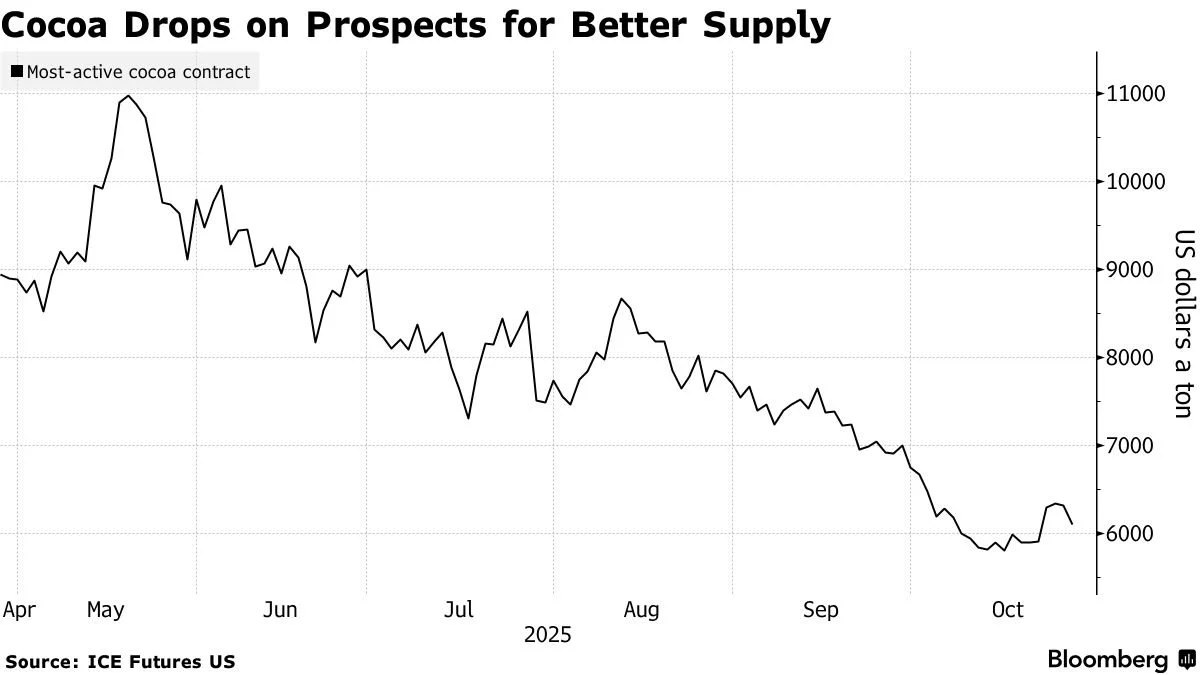

After a tumultuous period marked by droughts, disease and logistical congestion, cocoa futures had dropped sharply earlier in 2025. For example, headline cocoa prices declined to just under US$6,000 per tonne.

One of the main reasons for the correction was the arrival of improved rainfall across key growing areas. Analysts note that the recent rains have mitigated some of the risk of failed flowering, bean drop and pod development, all critical for crop volumes.

It’s worth noting, though: the improvement is uneven, and delays in port deliveries remain a factor. For instance, in Côte d’Ivoire early-season arrivals were below the previous season while the rains were heavy in coming.

Implications for volume and quality

From a supply-chain vantage point, what matters isn’t just how much cocoa is produced, but when, how fast it moves, what grade it is, and how logistical bottlenecks may amplify cost.

The better rainfall outlook offers hope for a stronger main crop, especially as the October-March harvest cycle kicks in. That gives exporters and buyers a little breathing room.

However, heavy rains can delay collection, cause transport access problems, and increase the risk of bean quality deterioration (mould, fermentation issues). These are real trade-flow risks.

Quality variations matter: if beans arrive late or weather-impacted, processors may need more sorting, which increases cost and reduces throughput.

Price rebound and market response

As supply fears ease, the price rebound is underway, though it remains tempered by weak demand in key consuming markets (Europe, North America) and trade-logistics friction. For example, one analysis shows that cocoa futures, while still well above decade averages, have entered a new “elevated normal”.

For trade operators, that means the window for advantage is shifting:

Buyers who locked in very conservative sourcing contracts may face higher costs if they delay.

Exporters and origin-country processors who can improve quality and logistics timing stand to capture premium margins.

Logistics managers must watch freight, port capacity and inland transport closely; delays can erode the gains from a better harvest.

Strategic take-aways: What this means for the supply chain

Diversification of origin and timing: With rainfall patterns increasingly unpredictable, relying on a single crop zone or harvest window is riskier. Building relationships across West Africa (and beyond) offers resilience.

Quality controls and early movement: With beans coming in potentially faster (due to improved rainfall) but still facing transport risks, prioritising forward planning of collection, sorting and movement is critical.

Inventory strategy and timing: As prices rebound, buyers must consider whether to increase coverage earlier rather than chase last-minute volumes at higher cost, especially given freight and handling risks.

Premiums and contract flexibility: Processors and manufacturers increasingly care about bean grade, traceability and sustainable yields. That means origin-contracting and premium contracts are more salient than simple tonnage purchases.

Outlook

While the rebound is real, let’s be clear: it’s not a full return to pre-crisis normal. Structural challenges remain: ageing tree stocks, disease pressure (e.g., CSSV, black pod), transport bottlenecks, and climate volatility all remain in play.

In the short to medium term, the improved rainfall gives a positive tilt to the 2025/26 season, and supply-chain actors should use this to strengthen sourcing strategy, logistics readiness and production planning. From a trade perspective, organisations that act now will be better positioned to capture value as the market stabilises.

Styyer Insight

“At STYYER, we recognise that cocoa is no longer simply a commodity; it’s a supply-chain barometer. The recent rainfall shifts in West Africa don’t guarantee volume, but they do shift the risk map. For sourcing managers, the time to act is now: revisit origin contracts, logistics flows and premium-bean strategies before market tilt catches up.”